USD/CAD is stalling the gains made as traders step aside for the Fed

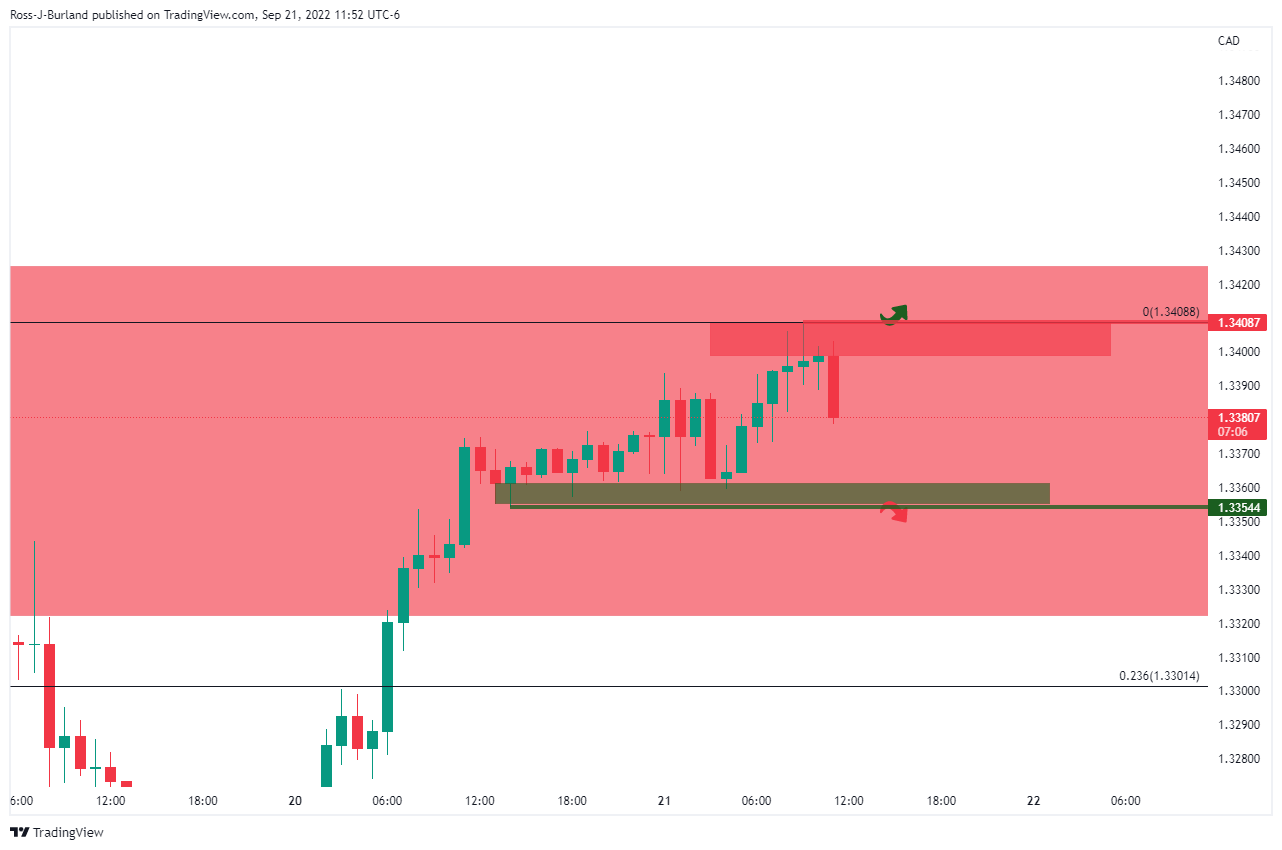

- USD/CAD bulls need to break 1.3410 and the bears 1.3350 around the Fed event.

- The Fed is expected to hike 75bps or even deliver 1 full basis point.

USD/CAD is starting to decelerate on the bid as we approach the Federal Reserve's interest rate decision at the top of the hour. At the time of writing, the pair is still higher by some 0.2% at 1.3395 after rallying on the day so far from a low of 1.3357 to a two-year high of 1.3408. Apart from the anticipation around a hawkish Fed, geopolitical tensions have bolstered safe-haven assets, weighing on the CAD despite an attempted recovery in the price of oil.

Russian President Vladimir Putin called up 300,000 reservists to fight in Ukraine and hinted to the West he was prepared to use nuclear weapons to defend Russia which has fuelled demand for the safe haven US dollar and Treasuries. In turn, however, the price of oil, one of Canada's major exports, has also jumped momentarily on the back of the escalation of the war that has raised concerns of tighter oil and gas supply.

However, the focus quickly turned back to the Federal Open Market Committee which concludes a two-day meeting today. The Fed is widely expected to lift interest rates by three-quarters of a percentage point for a third straight time. There is some speculation of a 1bp hike to borrowing costs in order to tame a potentially corrosive outbreak of inflation.

''We expect the FOMC to deliver its third consecutive 75bp rate hike, bringing the policy stance decidedly above its estimate of the longer-run neutral level,'' analysts at TD Securities said.

''We also look for the Committee to provide more hawkish signals through the update of its economic projections and for Chair Powell to build on his Jackson Hole message.''

''Treasuries should respond to the size of the hike, the 2023/2024 dots, and Powell's tone on further tightening. Given the hawkish market positioning, a "sell the rumor, buy the fact" reaction is possible.''

''Buy the rumor, sell the fact is a tempting play for the USD, but we are wary that the messaging at this meeting will be more hawkish than usual. Neutral bias and reassess after.''

Meanwhile, the Bank of Canada's Deputy Governor Paul Beaudry said that inflation in Canada remains "too high" but is headed in the right direction. This followed an inflation report that missed the mark but the deputy governor remained adamant that the central bank needed to do whatever is needed to bring price increases back to target.

USD/CAD technical analysis

The weekly charts show the price is attempting to break out of the chennel. If the Fed disappoints the hawks, then the greenback could come under pressure and see USD/CAD snapping back into the channel from resistance towards prior support near a 50% retracement or even to a 61.8% ratio for the coming days.

For the Fed event, the following hourly support and resistances are key: