हमारे सर्वश्रेष्ट स्प्रैड्स और शर्तें

अधिक जानें

अधिक जानें

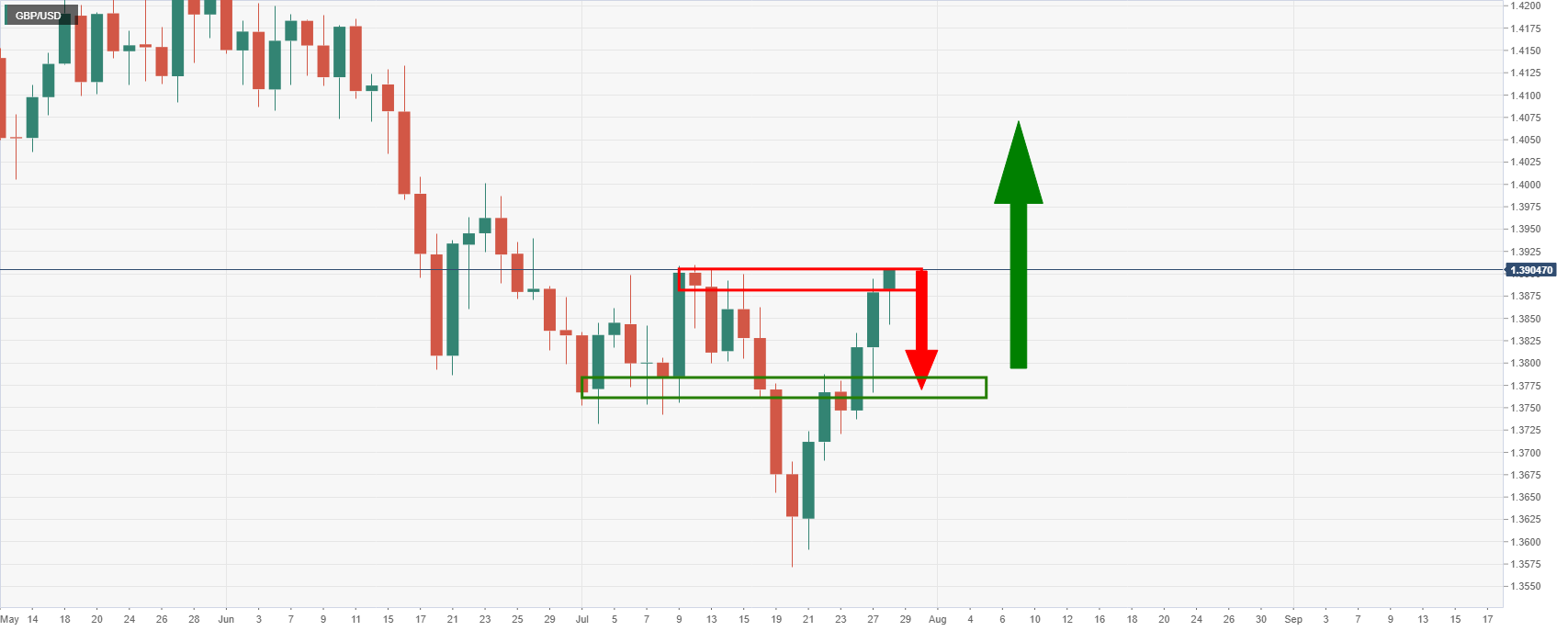

GBP/USD is trading near 1.3900 during the conclusion of the two-day Federal Open Market Committee meeting with what appears to be some 'temporary' US dollar weakness playing out.

The statement has been released and Fed's chairman, Jerome Powell is currently speaking at a press conference.

This event was widely seen as a placeholder meeting and the market's expectations have been widely met, so far.

The market was looking for a modestly hawkish hold which is what the statement and press event, so far, has offered.

Consequently, the markets are holding in a tight familiar range as the expectations of the acknowledgements of inflation risks, risks of the delta variant and discussions of tapering all came to pass.

The statement that the

"conomy has made progress toward goals since setting the bar for taper in December and will continue to assess progress in coming meetings,"

should be received well by the US dollar bulls.

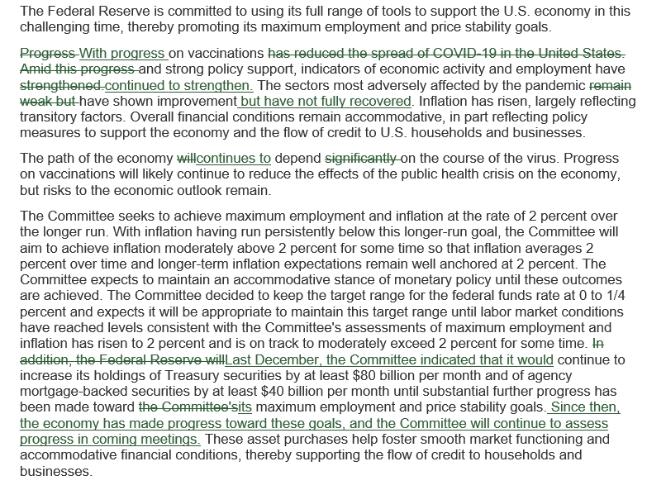

The changes that do stand out in the statement are as follows:

1. The FOMC removed this entire line: "Progress on vaccinations has reduced the spread of COVID-19 in the United States".

2. An addition, "Not fully recovered".

3. The Fed "made progress" towards taper goals.

The following highlights the changes between the Jun 16, 2021 and Jul 28, 2021 FOMC meetings:

(Source: TD Securities)

Markets are now hinging on the words of the Fed's chair, Jerome Powell in the Press conference which has started.

''We are still a ways off from considering raising interest rates.''

''In near-term, risks to inflation are to the upside.''

''Has confidence in medium-term inflation will move back down.''

Powell speech: The labor market has a ways to go

The reaction to these comments in the US dollar are in contrast to the bond market's, so the moves to the downside in the greenback may only be a temporary knee jerk reaction.

Firstly, the US dollar should be analysed for a broad picture and the price has been tinkering on the edge of critical trendline support which is coming under pressure during the presser as follows:

This is a bullish backdrop for cable:

With that being said, there are prospects of a retest of the critical support block below from a daily perspective if the greenback turns around over the month-end: