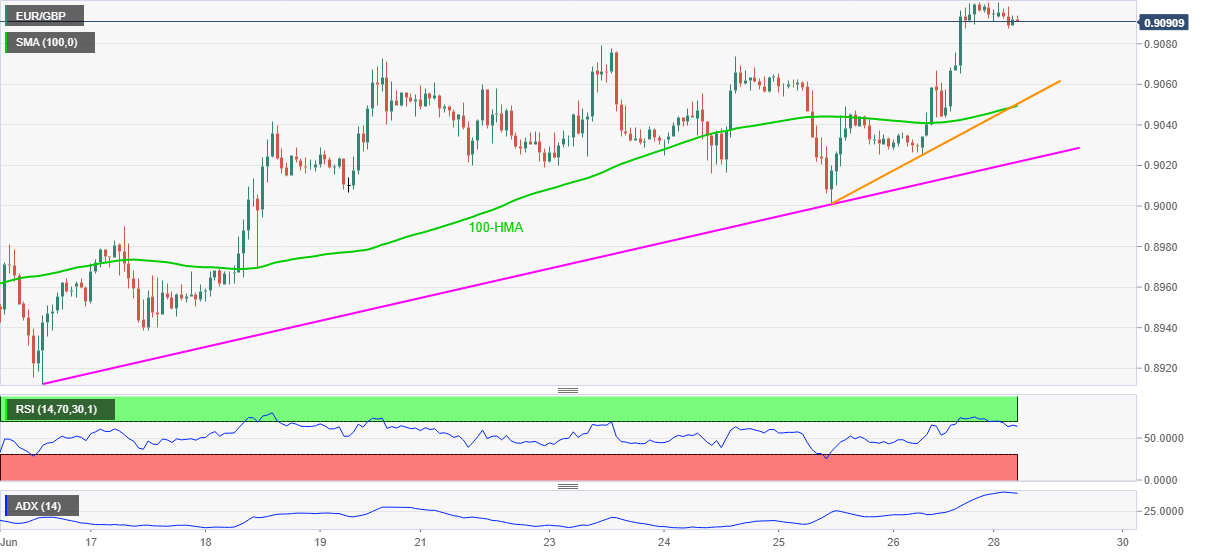

EUR/GBP Price Analysis: Rounding top near three-month high keeps sellers hopeful below 0.9100

- EUR/GBP eases from intraday high amid RSI and ADX taking U-turn from the overbought region.

- A two-day-old support line, 100-HMA offers key support ahead of a two-week-long rising trend line.

- Bulls may aim to refresh the yearly top during further upside.

EUR/GBP trades near 0.9090, close to the highest since March 26, amid Monday’s Asian session. The pair seems to fade upside momentum and portray a rounding top bearish chart pattern on the hourly formation. Also favoring the odds of further pullback could be the RSI and ADX conditions.

However, the sellers might wait for a clear break below June 23 high if 0.9078 before targeting a confluence of 100-HMA and immediate support line, near 0.9050.

During the pair’s further downside past-0.9050, an ascending trend line from June 16, at 0.9021, followed by 0.9000 psychological magnet could entertain the bears.

Meanwhile, the pair’s upside break of 0.9100 enables it to challenge the multiple resistances around 0.9150 ahead of confronting a 0.9300 upside barrier.

It should, however, be noted that the pair’s ability to cross 0.9300 might take only one stop around 0.9400 mark ahead of challenging the yearly peak surrounding 0.9500.

EUR/GBP hourly chart

Trend: Pullback expected