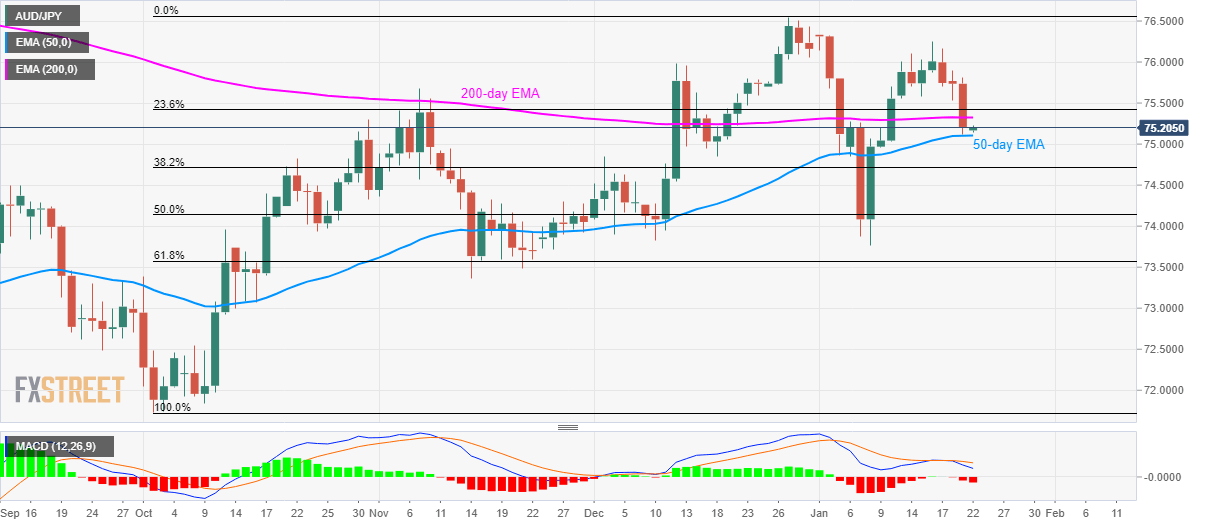

AUD/JPY Price Analysis: Bounces off 50-day EMA amid bearish MACD

- AUD/JPY revisits the sub-200-day EMA area after eight days.

- Early-December top, 38.2% Fibonacci retracement can please sellers during further declines.

- 23.6% Fibonacci retracement adds to the short-term resistance.

AUD/JPY recovers to 75.20 amid the initial Asian session on Wednesday. The pair declines below 200-day EMA during the previous day but took a U-turn from 50-day EMA. Even so, bearish MACD favors the sellers.

Hence, a downside break of 50-day EMA level of 75.10 can extend Tuesday’s declines towards December 03 high near 74.85 ahead of highlighting 38.2% Fibonacci retracement of the pair’s rise between October and December months, at 74.70.

In a case where AUD/JPY prices keep trading southward past-74.70, 50% Fibonacci retracement and the monthly low could entertain the bears around 74.15 and 73.75 respectively.

Meanwhile, the pair’s daily closing beyond a 200-day EMA level of 75.32 enables it to challenge 23.6% of Fibonacci retracement at 75.42.

However, January 16 peak around 76.25 and the previous month's top surrounding 76.55 could question the bulls during the additional run-up.

AUD/JPY daily chart

Trend: Pullback expected