USD/CAD extends losses as oil rises

The USD/CAD pair dropped to a new weekly low at 1.3328 as the oil rising prices are increasing the demand for the commodity-linked currency - Loonie. At the moment, the pair is down 0.56% at 1.3334.

Although the price for the barrel of West Texas Intermediate has struggled to break above the $53 area during the day, Kuwait Oil Minister's comments gave an additional boost for the black gold. Kuwait Oil Minister Essam al-Marzouq suggested that global crude stocks could continue to drop in the next few months. At the moment, the barrel of WTI is gaining 1.53% at $53.04.

In the meantime, the US Dollar Index can't gather any upside momentum after breaking below the 101 handle and is not allowing the pair to recover any losses. The index has been spending the last few hours in a narrow band between 100.95 and 100.90 awaiting Federal Reserve Chair Yellen's speech that is scheduled to start at 20:00 GMT.

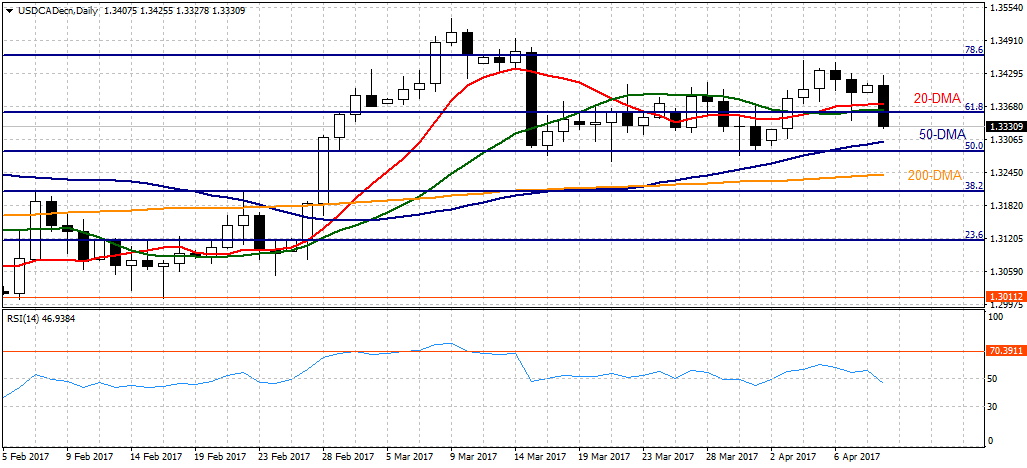

Technical outlook

To the upside, resistance levels for the pair could be located at 1.3370 (20-DMA), 1.3450 (Apr. 6 high) and 1.3500 (psychological level). On the flip side, supports could be seen at 1.3300 (psychological level/50-DMA), 1.3240 (200-DMA) and 1.3205 (Feb. 22 high).

- CAD: Technical indicators are not generating strong signals - BBH